International stocks have underperformed for so long it makes sense many investors assumed the turnaround last year was a blip.

Maybe it will be in the grand scheme of things but the ex-U.S. trade is gaining steam.

Let’s run through some charts.

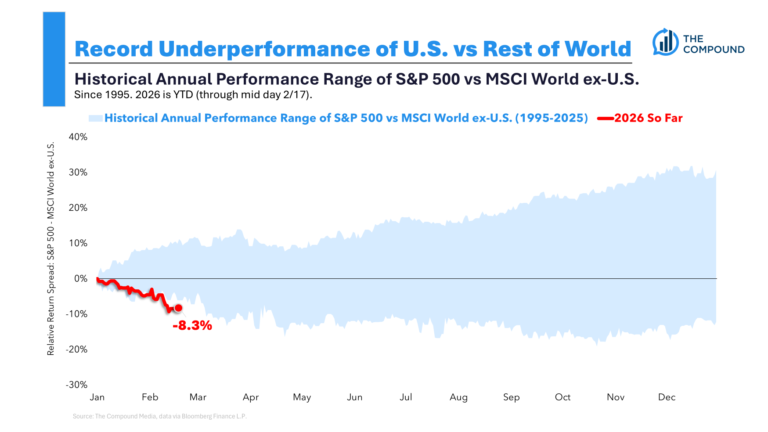

This is the best start to the year since 1995 in terms of foreign outperformance over U.S. stocks:

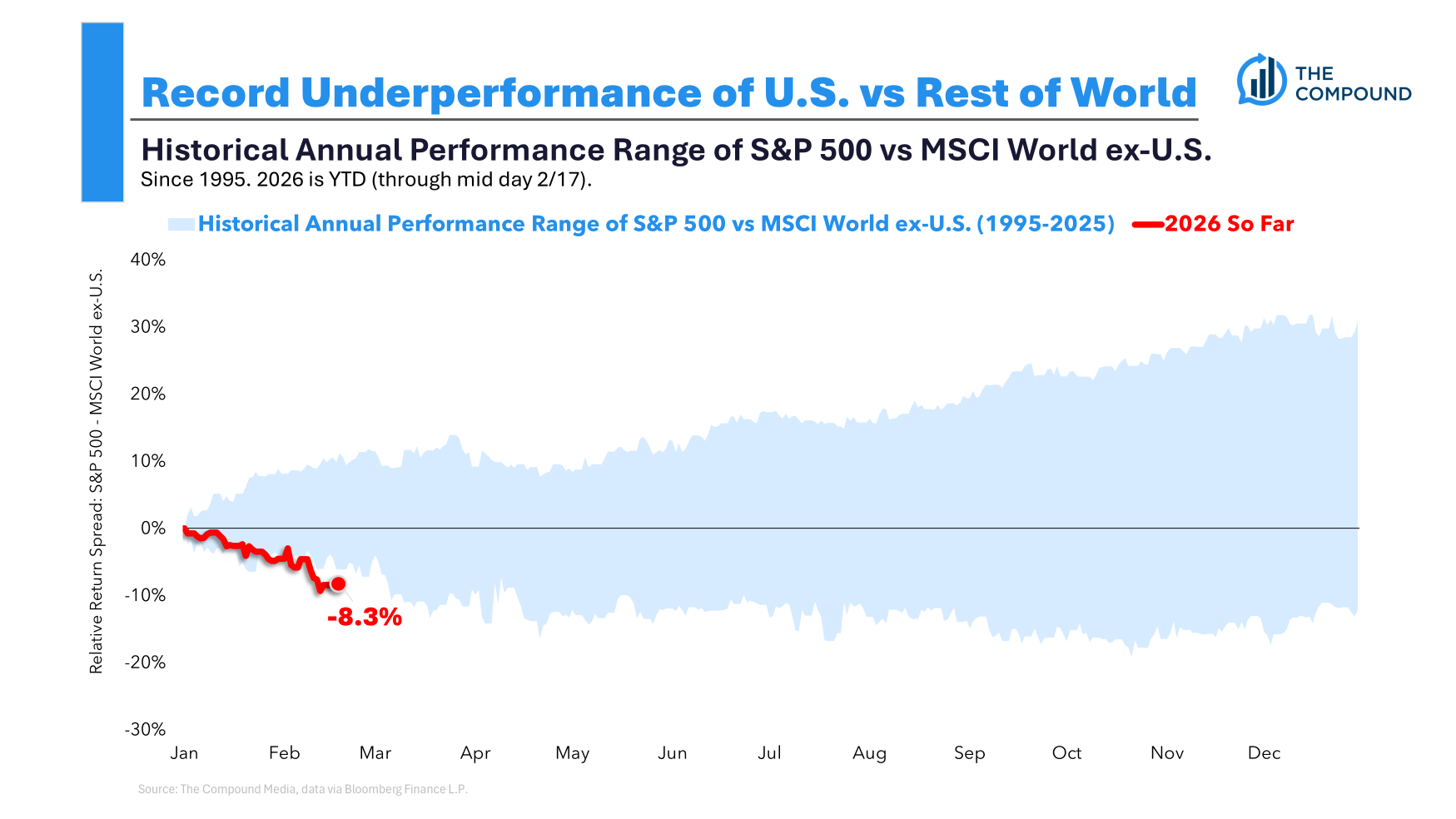

If you look back to the start of 2025, the outperformance by European stocks, Asian stocks and emerging markets is now quite large:

This is a little more than a year’s worth of performance so it’s understandable many investors don’t trust this rally. The U.S. stock market has been the only game in town for many years now.

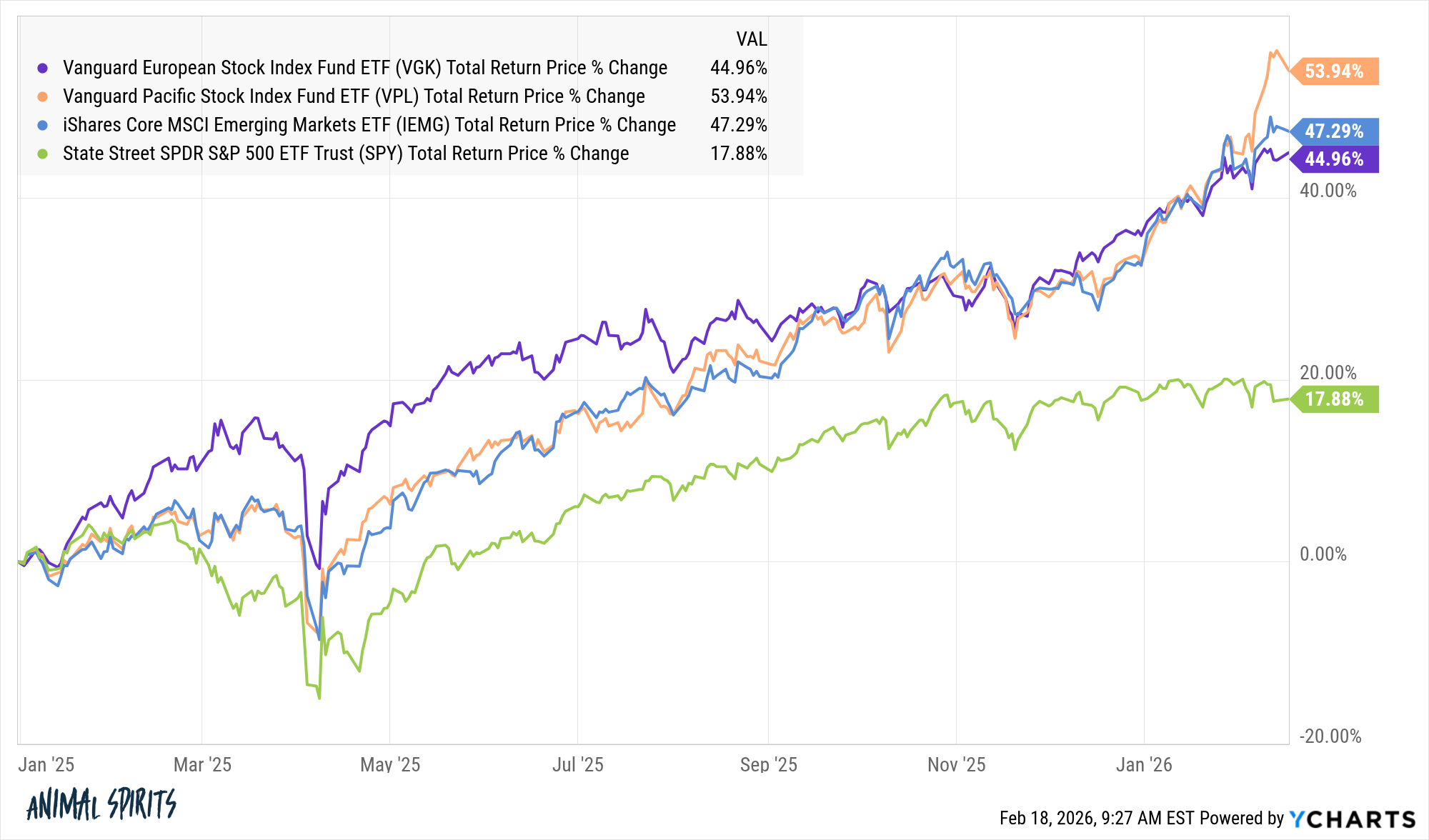

But look at the returns for Germany, South Korea and international small cap value stocks over the past 5 years:

All are outperforming the S&P 500 over a 5 year period.

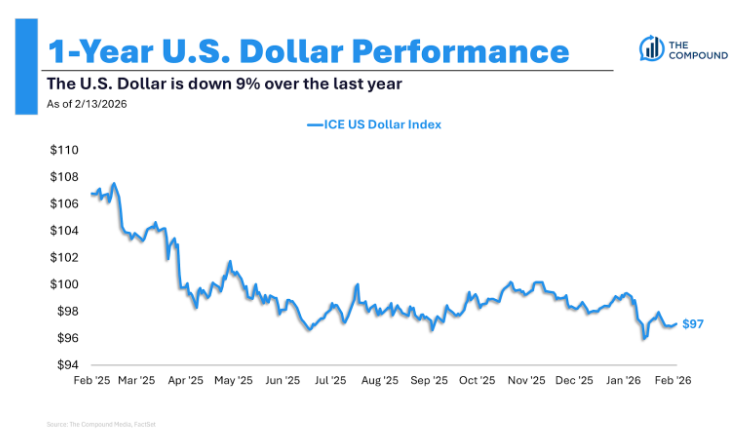

One of the big reasons for the outperformance is the falling dollar.

That’s a tailwind for U.S.-based investors in foreign shares.

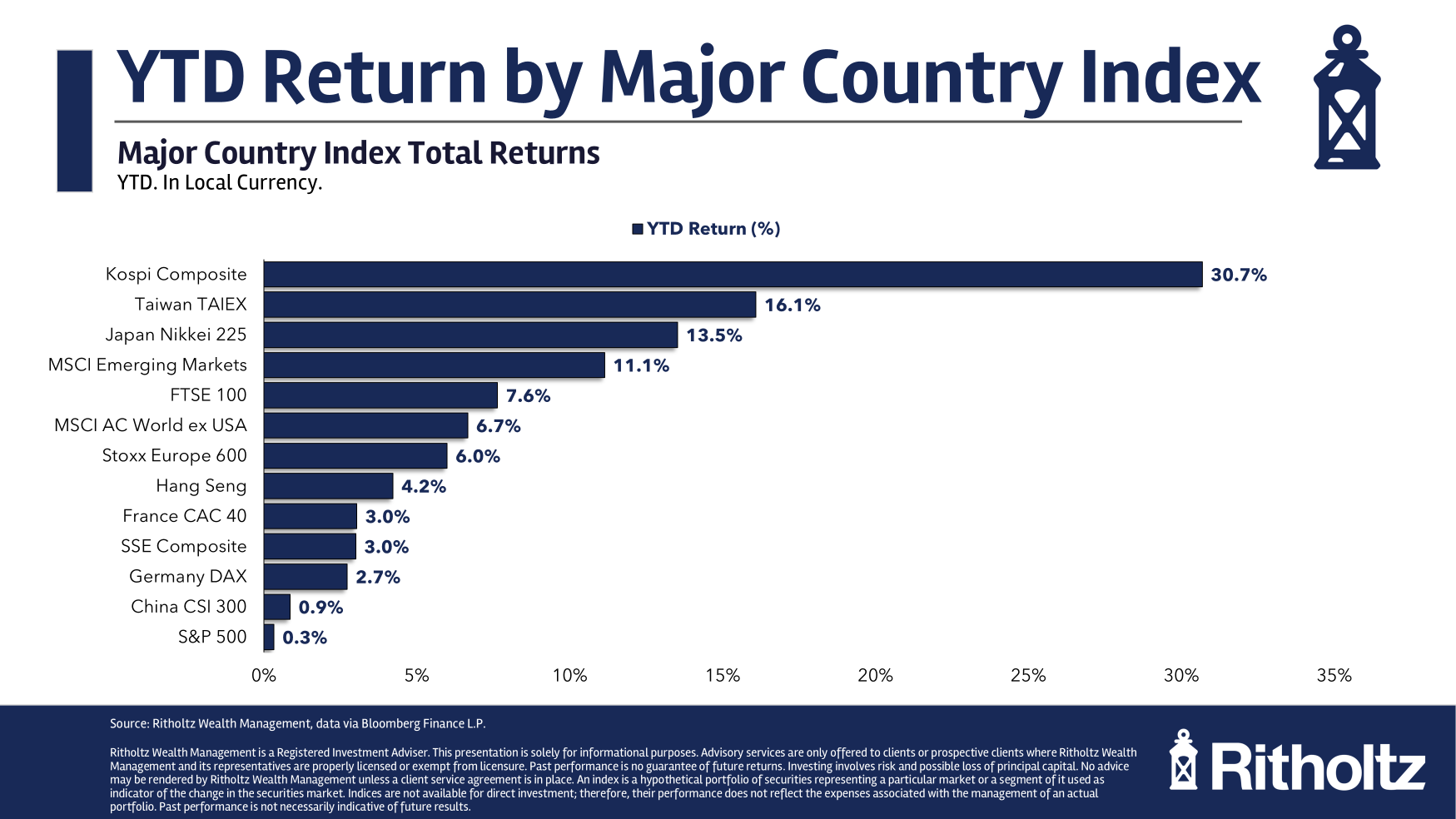

But this is not just a currency play. Even in the home currencies, these stock markets are outperforming the S&P 500 this year:

I don’t know how long this will last. Tech stocks have been so dominant in the U.S. for so long that some skepticism is warranted.

However, it’s possible this new cycle has legs.

U.S. officials seem to want a lower dollar through their policies. The trade war has changed the way investors and corporations view the United States. If de-globalization really is happening, other countries begin loosening their fiscal purse strings, and they keep adding shareholder-friendly policies, international stocks could keep winning on a relative basis in a new cycle.

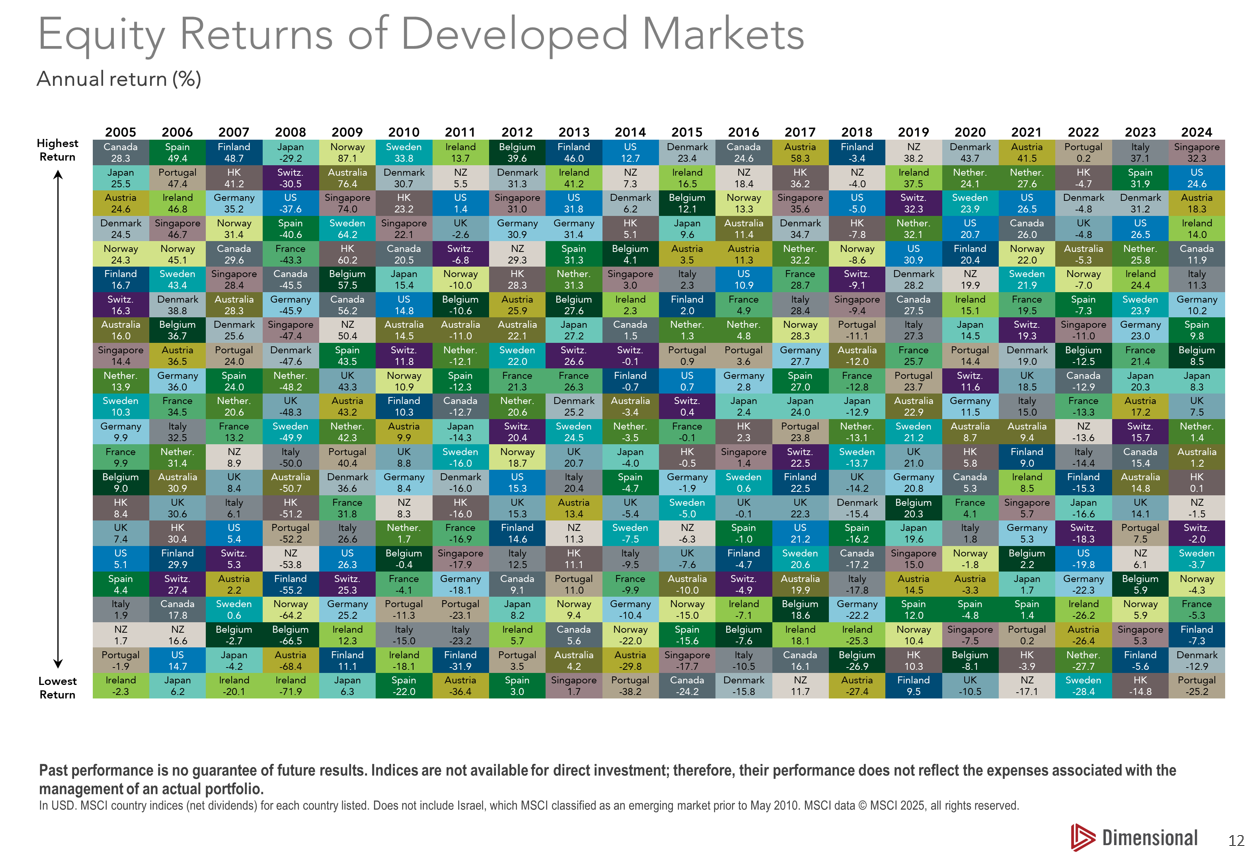

As a diversified investor, I don’t try to pick the winners in advance. That’s true for asset classes and countries. Dimensional Fund Advisors has a great chart that ranks developed market country stock performance by year:

Just like asset classes, there is no rhyme or reason from one year to the next in terms of the best and worst performers.

A lot of investors have given up on international diversification in recent years, and I don’t necessarily blame them.

I still think it adds value especially in an ever-changing world.

I filled in for Michael on What Are Your Thoughts this week with Josh where we talked international stocks, the great rotation, AI, software stocks, taxing the rich and more:

Podcast version here:

Further Reading:

Is Diversification Finally Working Again?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.