Older people are having a moment in the economy.

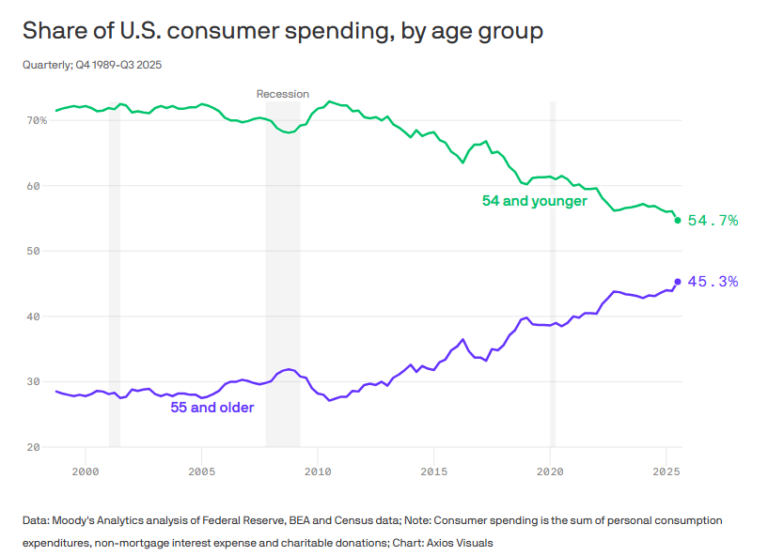

According to Axios, people 55 and older now make up more than 45% of spending in America:

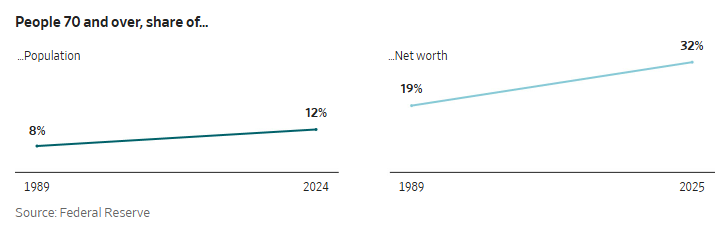

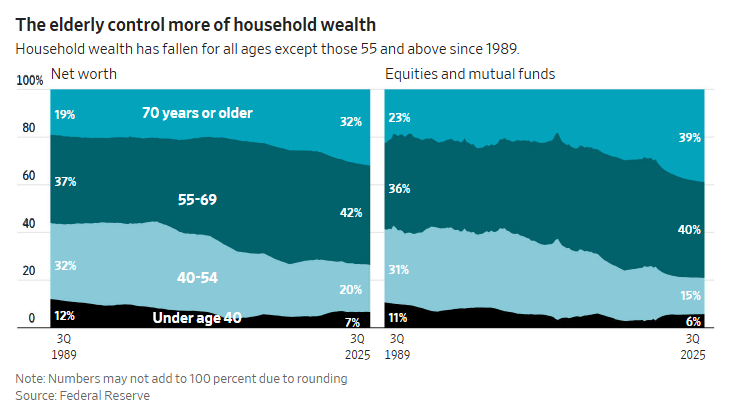

The Wall Street Journal shows that the 70 and over crowd now controls around a third of the net worth:

Those 55 and older control almost three-quarters of the wealth:

These kinds of numbers make A LOT of younger people very angry.

I understand the resentment/annoyance/frustration. If you’re not getting ahead, feel like you’re falling behind, don’t own a home or much in the way of financial assets, I get it — you have to blame someone.

There is some context required though.

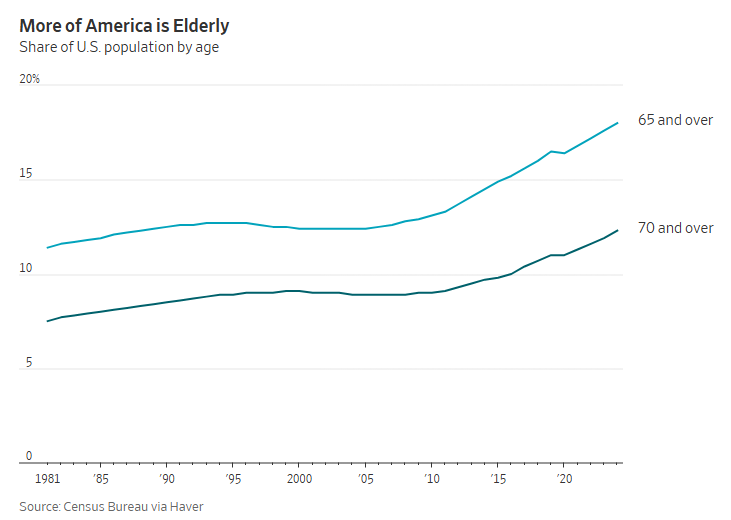

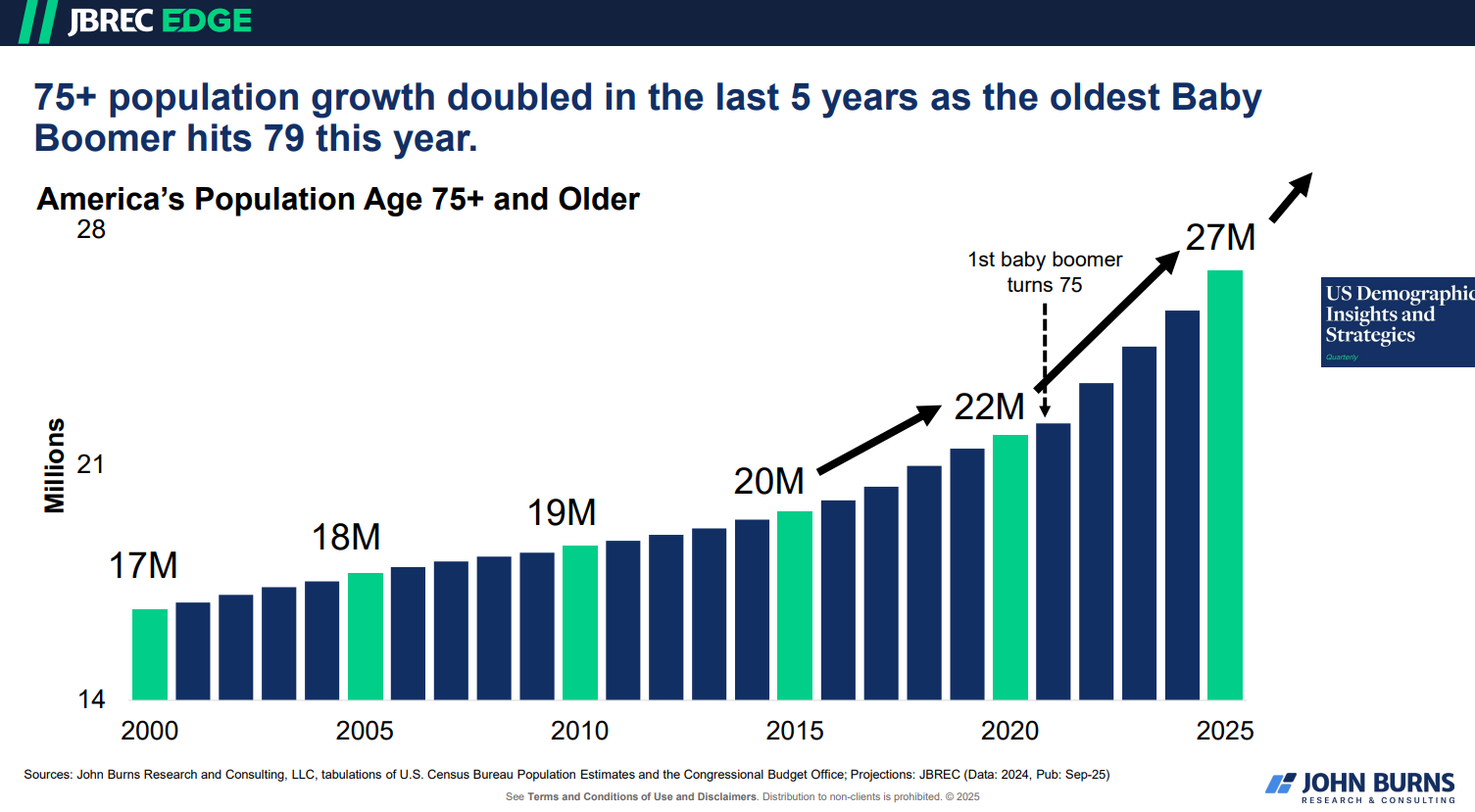

There are more old people than ever before!

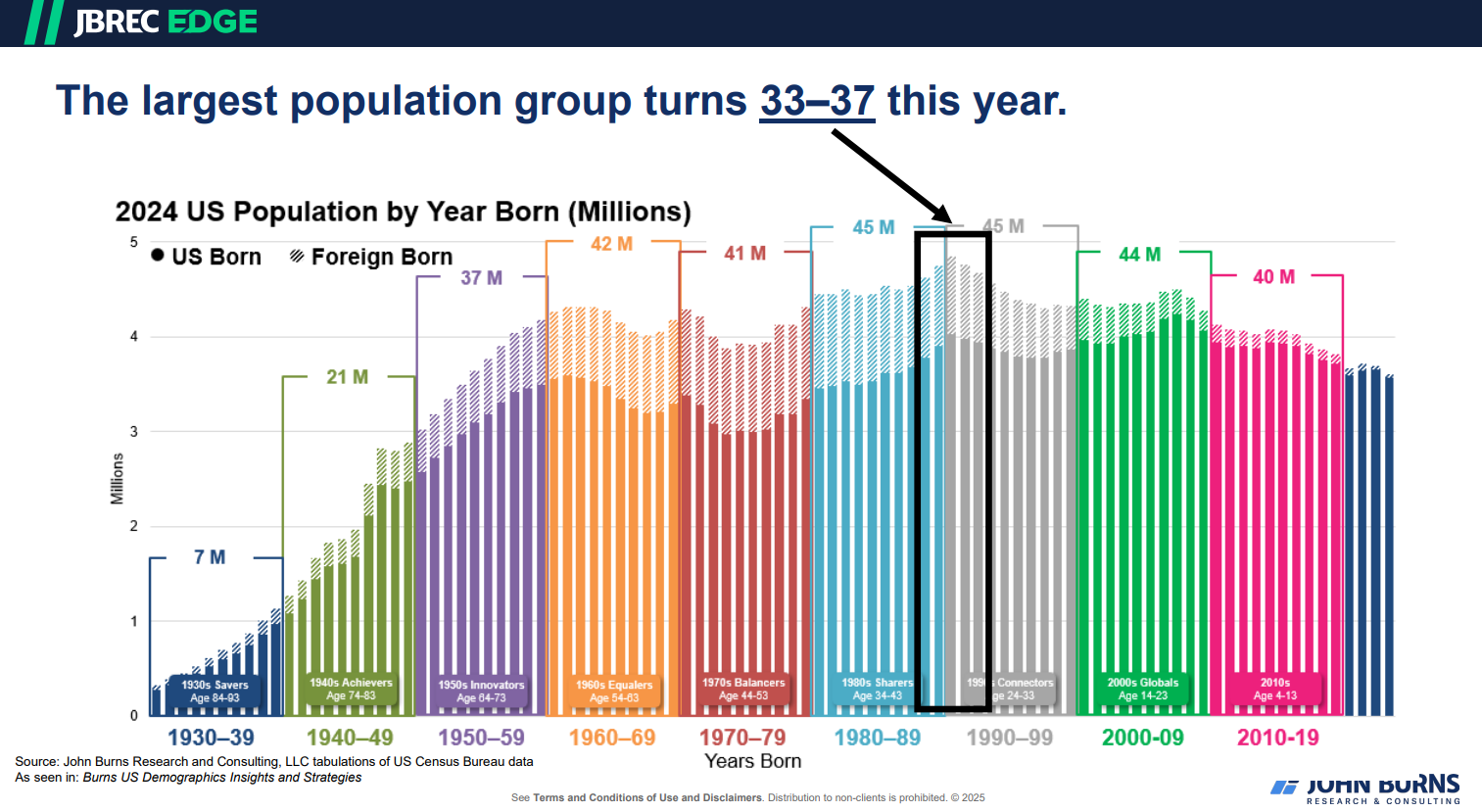

Eric Finnigan from John Burns has some great charts on demographics.

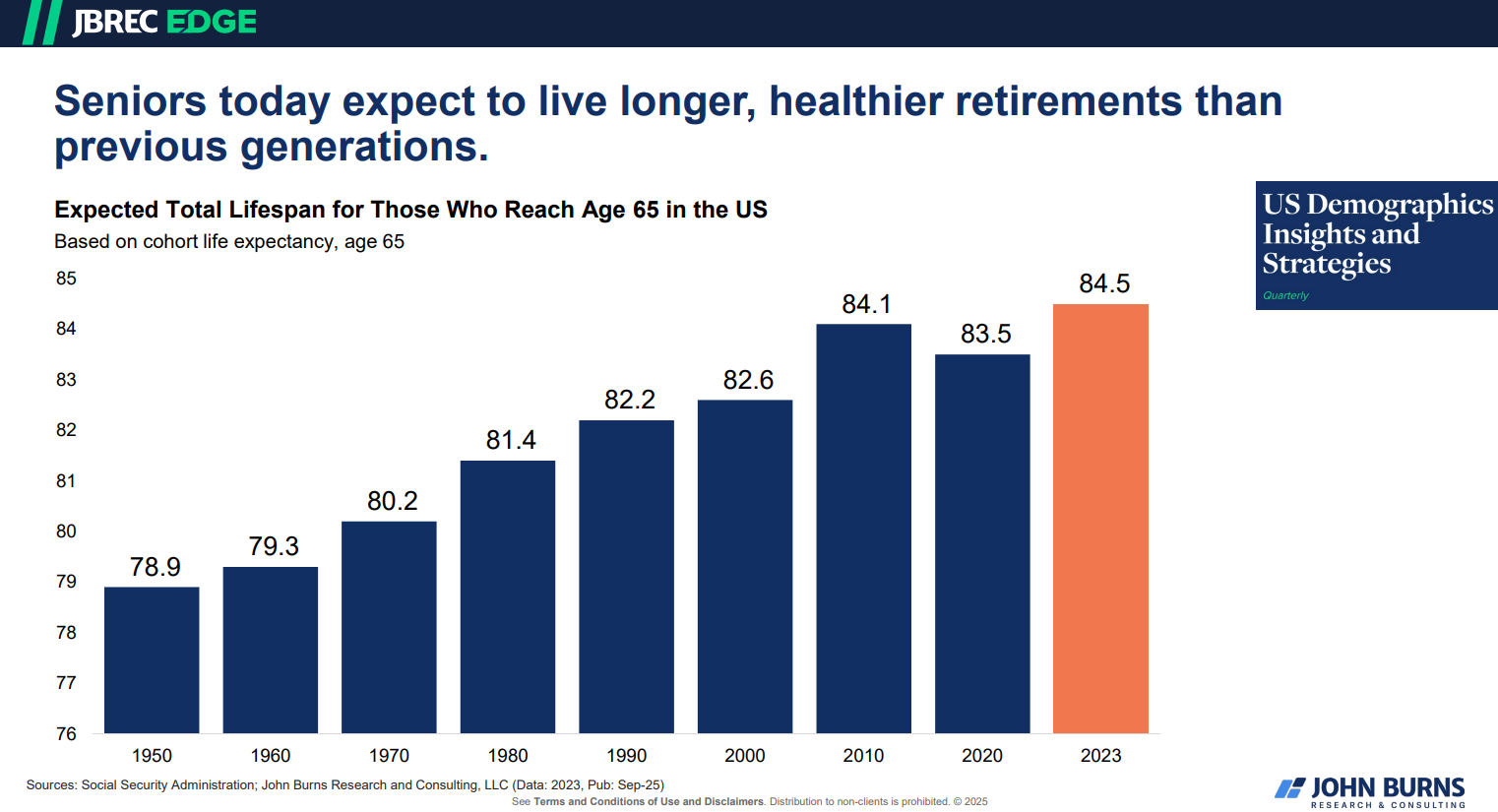

We’ve never had a generation as big as the baby boomers. They’re living longer than previous generations:

These numbers will keep rising:

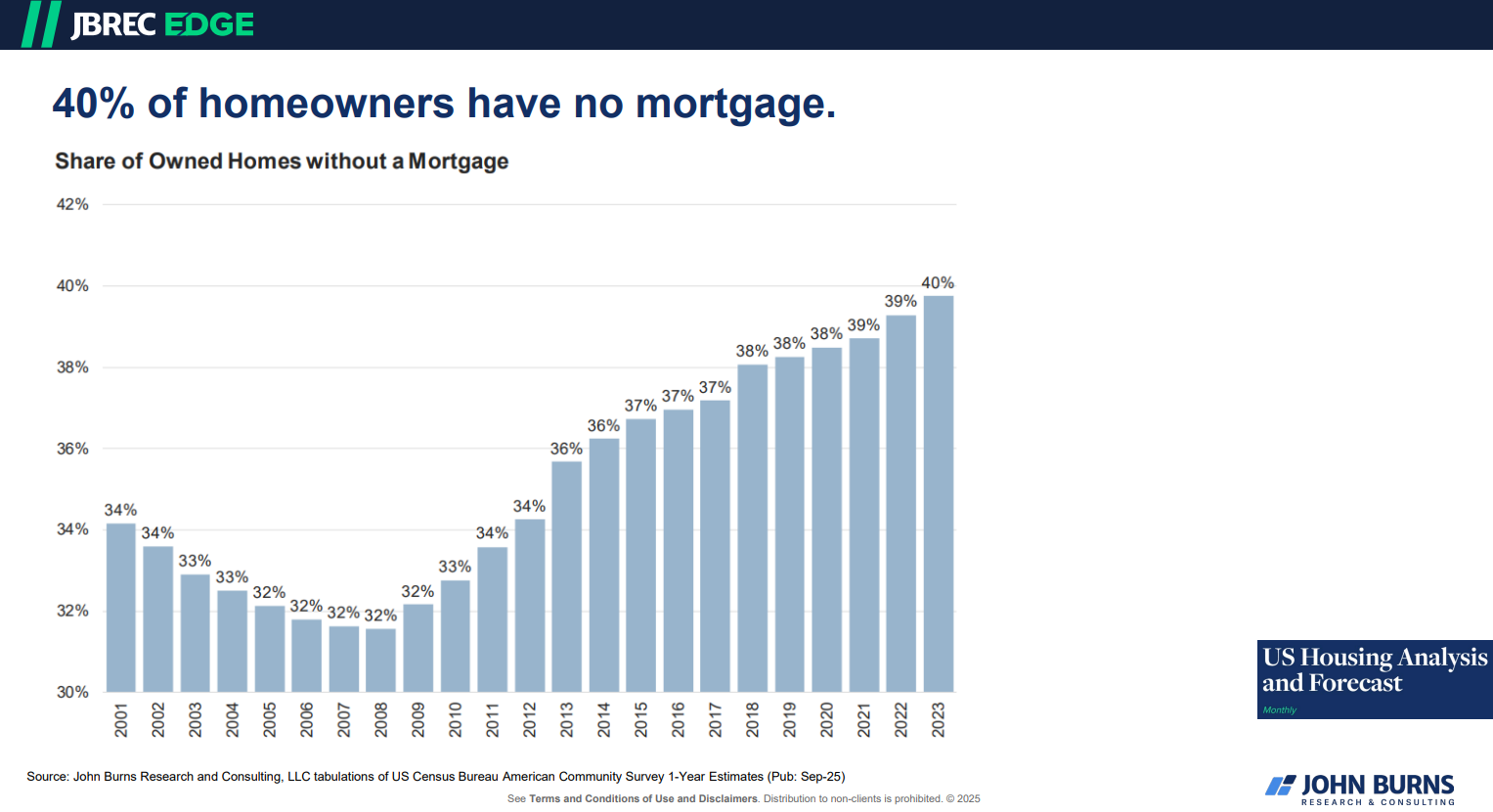

Many of them have paid off mortgages:

This is also the first group in history to have access to IRAs and 401ks. They’ve had many decades of wonderful returns in the financial markets to allow their assets to compound.

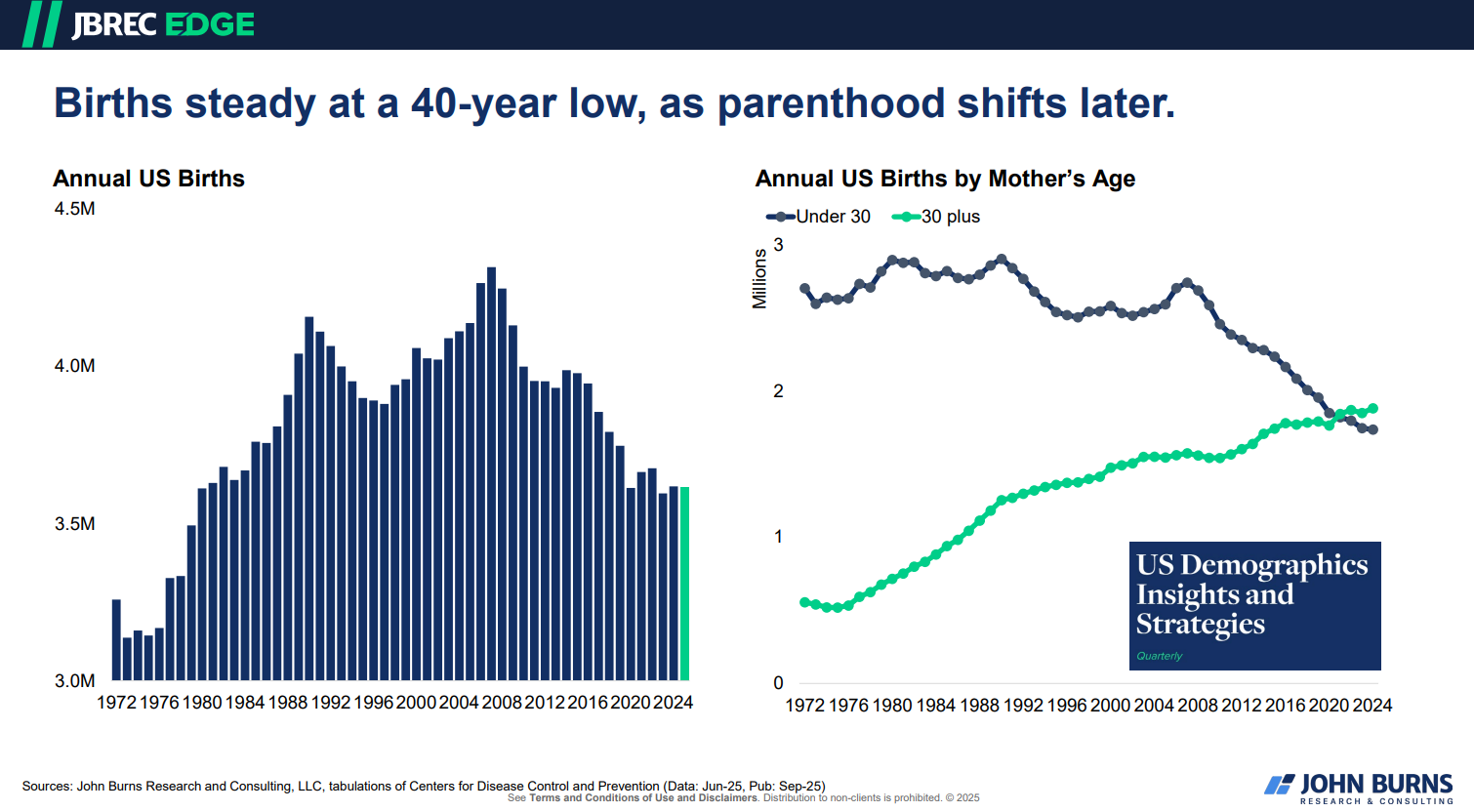

Young people are settling down later in life too:

The thing is, as big as the baby boomer generation is, the millennial generation is slightly larger. The largest cohort in the U.S. is now in their prime household formation range:

There are a lot of buyers on the sidelines right now because housing affordability is so out of control. Sure, some of these people will stay renters but many will eventually get sick of waiting and pull the trigger, high housing prices be damned.

It’s also true that Father Time is undefeated.

Many of the older generation’s financial assets — including homes — will be passed down when they pass away.

The Wall Street Journal has some estimates:

Gen Xers and Millennials are set to inherit $4.6 trillion in global real estate over the next 10 years, according to the report, which incorporated data from research firms Altrata and Cerulli Associates. Nearly $2.4 trillion of that property is located in the U.S.

Boomers can’t take it all to the grave with them.

How will this impact the housing market?

Will the next generation sell these homes? Live in them? Renovate and rent them out?

Is there a Silver Tsunami of homes coming to market because of it? A light drizzle?

Eric joined me on Talking Wealth this week to talk demographics, what it means for the housing market and much more:

Further Reading:

The Destiny of Demographics

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.