As a way to introduce the concept of investing to my kids, I started buying them shares of companies they would know and understand.

One of those companies is Disney.

They love all of the movies, the soundtracks, the characters, watching Disney Plus and of course the most magical place on earth – Disney World.

Well kids, here’s a lesson for you about stock-picking:

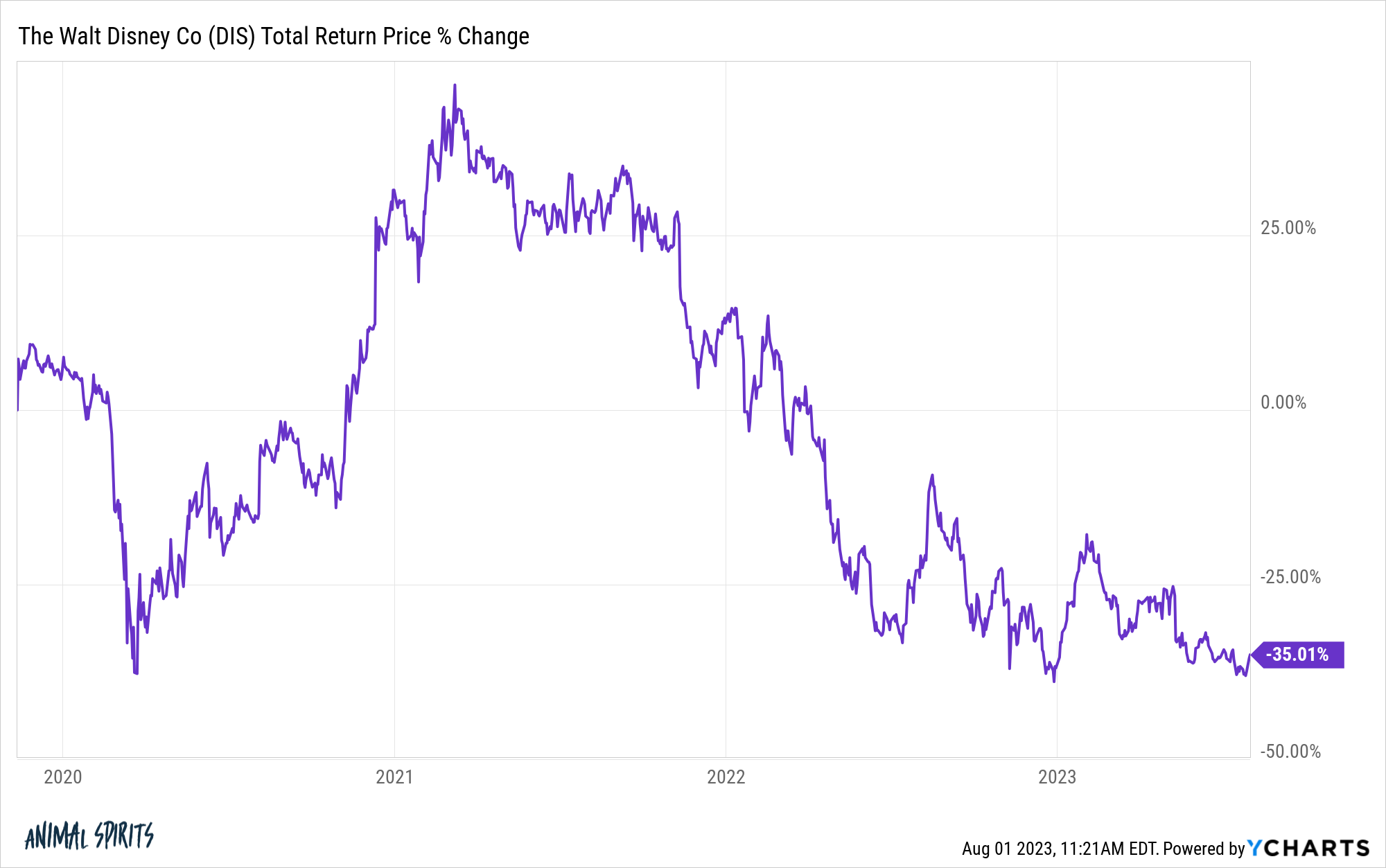

Since late-2021, shares of Disney are down more than 55%. Since Disney Plus launched in November 2019, the stock is down 35%. In that same time, the S&P 500 is up nearly 60%.

Disney Plus blew away even the most bullish estimates for potential subscriber growth but they spent way too much money to get those subscribers.

Bob Iger sat down for an interview with CNBC’s David Faber a few weeks ago for a post-mortem about what went wrong.

Here’s Iger on why Marvel movies and TV shows have been underperforming of late:

I’m very objective about that business and there have been some disappointments. We would have liked some of our more recent releases to have performed better. It’s reflective for – not as a problem from a personnel perspective, but I think in our zeal to basically grow our content significantly to serve mostly our streaming offerings, we ended up taxing our people way beyond in terms of their time and their focus way beyond where they had been. Marvel’s a great example of that. They had not been in the TV business at any significant level. Not only did they increase their movie output, but they ended up making a number of television series. And frankly, it diluted focus and attention. And I think you’re seeing that as I think more of the cause than anything else.

Just look at the sheer volume of Marvel projects1 they’ve put out:

If a little bit of something is good a lot of it has to be even better, right?2

Eventually, the quality and interest had to go down. There are only so many times you can save the world from extinction with poorly done CGI before people are over it.

It was too much of a good thing.

The same rule applies to investing.

Investors tend to get too greedy during bull markets and too fearful during bear markets, often taking too much risk following the former and getting too conservative following the latter.

The Wall Street Journal talked to a handful of investors in a new story about what it’s like to invest in a world with yield on your savings for the first time in decades.

Here’s a smart take by someone they profiled in the story:

Laura Kisailus, 44, a strategic communication consultant in Pittsburgh, says she and her husband have been buying short-term Treasury bills with yields of nearly 5.5% directly through the government’s website.

“How does it feel that we’re outpacing our mortgage with Treasurys? It feels good,” she said. “And now we’re beating inflation, plus there’s no state or local income tax. Actually, it feels great.”

This is one of the biggest reasons higher interest rates haven’t had as big of an impact as many economists assumed. Consumers locked in low borrowing costs and are now able to deploy their savings into 5-6% T-bill yields.

It’s crazy to think you can now earn yields on 1-3 month Treasury bills that are nearly two times higher than the rate on your 30 year mortgage from just a few short years ago.

But here is where this thought process loses me:

“We aren’t going to get rich on T-bills, but we aren’t going to lose it by rolling the dice on the stock market,” she added.

I do understand why certain investors become enamored with cash after getting taken for a ride by the stock market.

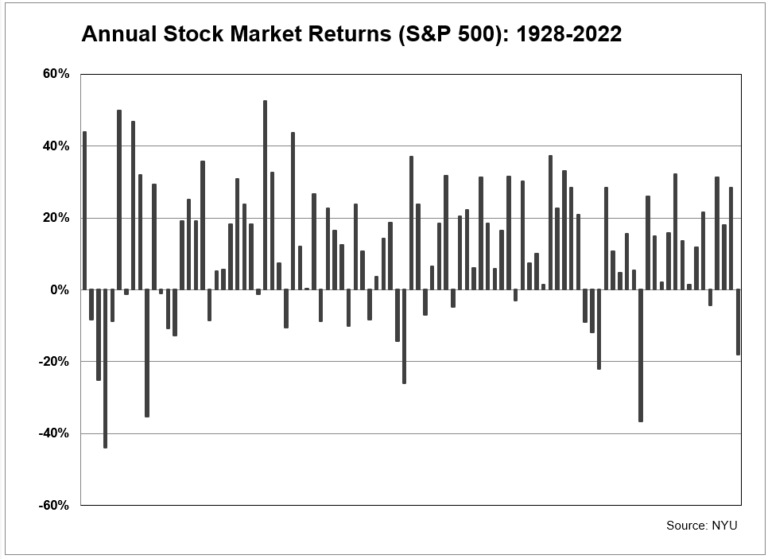

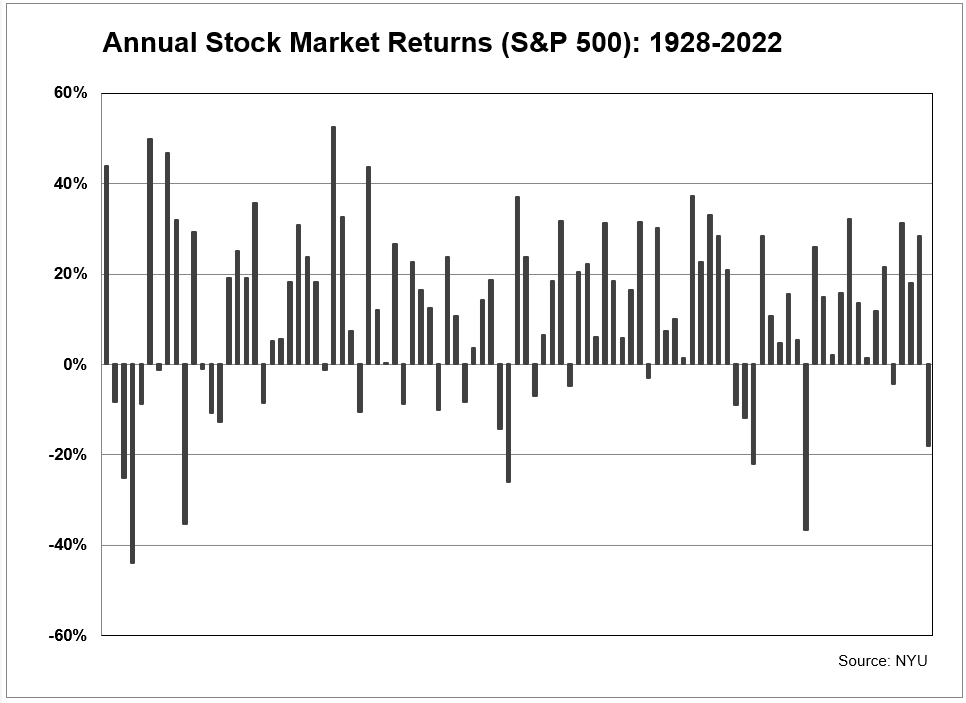

Here is a look at the calendar year returns on the stock market from 1928-2022:

They’re all over the place. Far more up years than down years but it’s not a smooth ride by any stretch of the imagination.

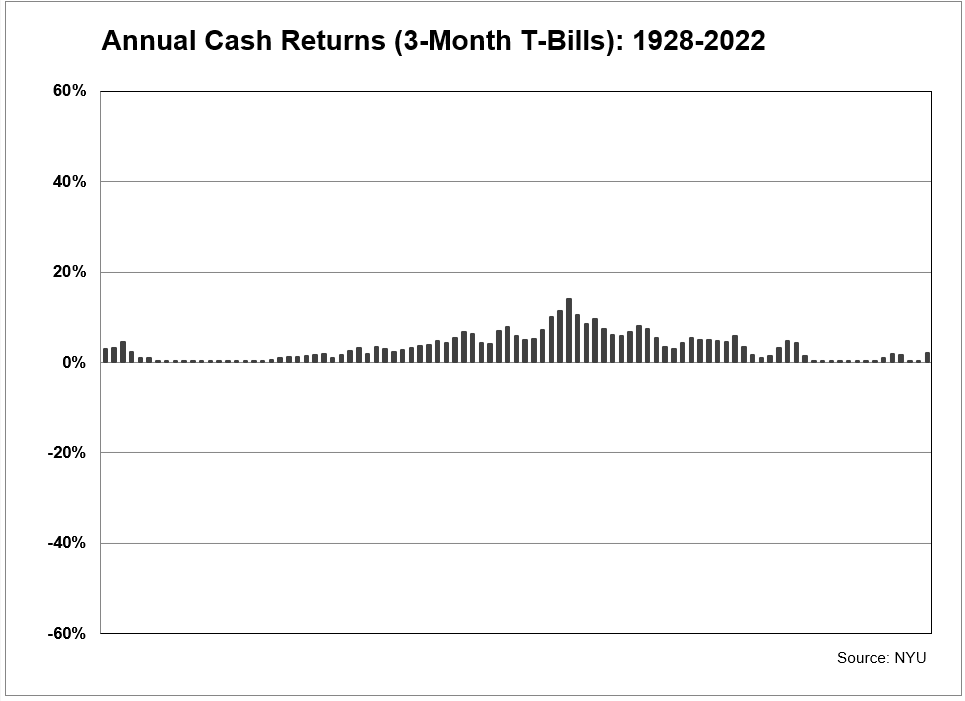

Now here’s a look at the returns on cash during this same time frame:

I used the same scale for each chart for a reason. It helps drive home the point that stock market returns have a much wider range of outcomes than the returns on cash in a given year.

You don’t have to be a brain scientist or rocket surgeon to notice cash returns are never down. Sure you don’t get the big up years like the stock market but your money is protected from losses.

Pretty good deal right?

No down years!

Sure, on a nominal basis holding cash can protect you from volatility and losses.

But over the long-run, holding cash is a much bigger risk to the threat of inflation.

From 1928-2022, the nominal gains for stocks and cash were 9.6% and 3.3%, respectively. Over that same time frame, inflation was running at 3% per year.

This means the real, after-inflation returns for stocks and cash were more like 6.6% and 0.3%.

Cash can help in the short-run but barely keeps up with inflation over the long-run.

Stocks can be painful in the short-run but are still your best bet for beating inflation over the long-run.

There is nothing wrong with utilizing conservative investments in your portfolio. Cash and short-term bonds can play a role in terms of helping you meet short-term liquidity needs, reducing overall portfolio volatility and keeping your emotions in check when the stock market loses its mind from time to time.

Savers have a right to be excited about higher yields for their savings.

However, unless you are fabulously wealthy, most people don’t have the ability to keep all of their money in ultra-conservative investments if they wish to improve their living standards.

Holding a lot of cash might seem like the prudent move right now considering where short-term yields are.

But it’s always good to have a little balance between the short-run and the long-run to spread your bets.

Too much of a good thing can sometimes be a bad thing.

Further Reading:

One Year Returns Don’t Matter

1You could have said the same thing about Star Wars or Pixar or many of the other Disney products in recent years.

2The success of Barbie is going to lead to this exact same problem. Just look at this slate of movies they plan to release here on the heels of Barbie’s success.