With inflation falling it’s looking more likely that we could see a soft landing in the U.S. economy.1

So now all of the economic pundits are fighting over who gets to take credit for it.

My stance is no one gets to take credit because everyone was predicting a recession and there are no counterfactuals.

You can’t say inflation was transitory because the Fed hiked rates so aggressively.

But I’m not going to give the Fed all of the credit because the unemployment rate didn’t rise which was their goal with the rate hikes. Plus they almost caused a banking crisis.

No one wins, which is probably always the case with economic predictions.

There is one thing we can say was transitory — the bear market.

This might seem like I’m stating the obvious because every bear market in history has been transitory.

I’m not usually a fan of taking a bullish or bearish stance on the stock market. The way you look at risk should be colored by where you are in your investing life cycle.

Extended bear markets can be risky for retirees who rely on their portfolios to fund their lifestyles. But bear markets are wonderful opportunities for young people who are saving money on a regular basis with time horizons measured in decades.

The stock market is also too unpredictable in the short-run to figure out when you should be bullish or bearish.

There are, however, times when I think it makes sense to consider long-term bullishness, even if you don’t know how the short-term is going to play out.

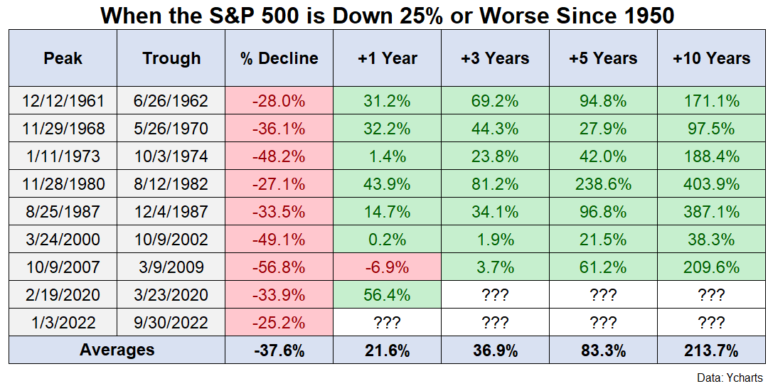

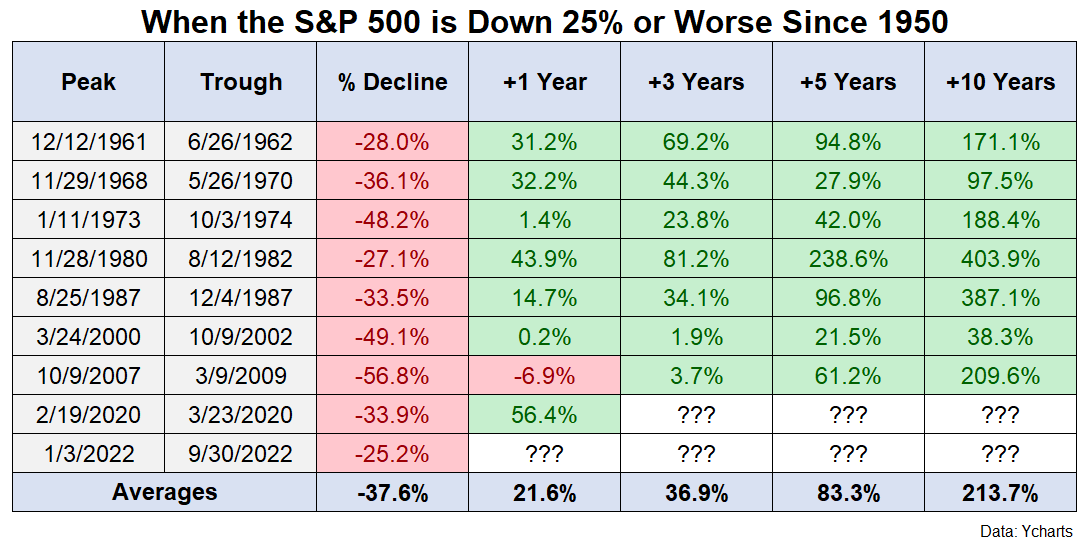

I wrote a post called Getting Long-Term Bullish in October of last year that looked at the historical returns from down 25% on the S&P 500 since 1950.

Here are some of the things I wrote at the time:

My general investment philosophy is the more bearish things feel in the short run the more bullish I should be over the long run.

If I’m taking my own advice right now I should be getting much more long run bullish.

It’s not easy.

Things are not great at the moment.

This is the performance chart I created since the S&P 500 was down 25% from all-time highs at that point:

I wish I could take credit for calling the bottom but this was my disclaimer at the time:

Past performance is no guarantee of future returns.

But I’m becoming more long-term bullish even if the short-term market observer in me still feels bearish.

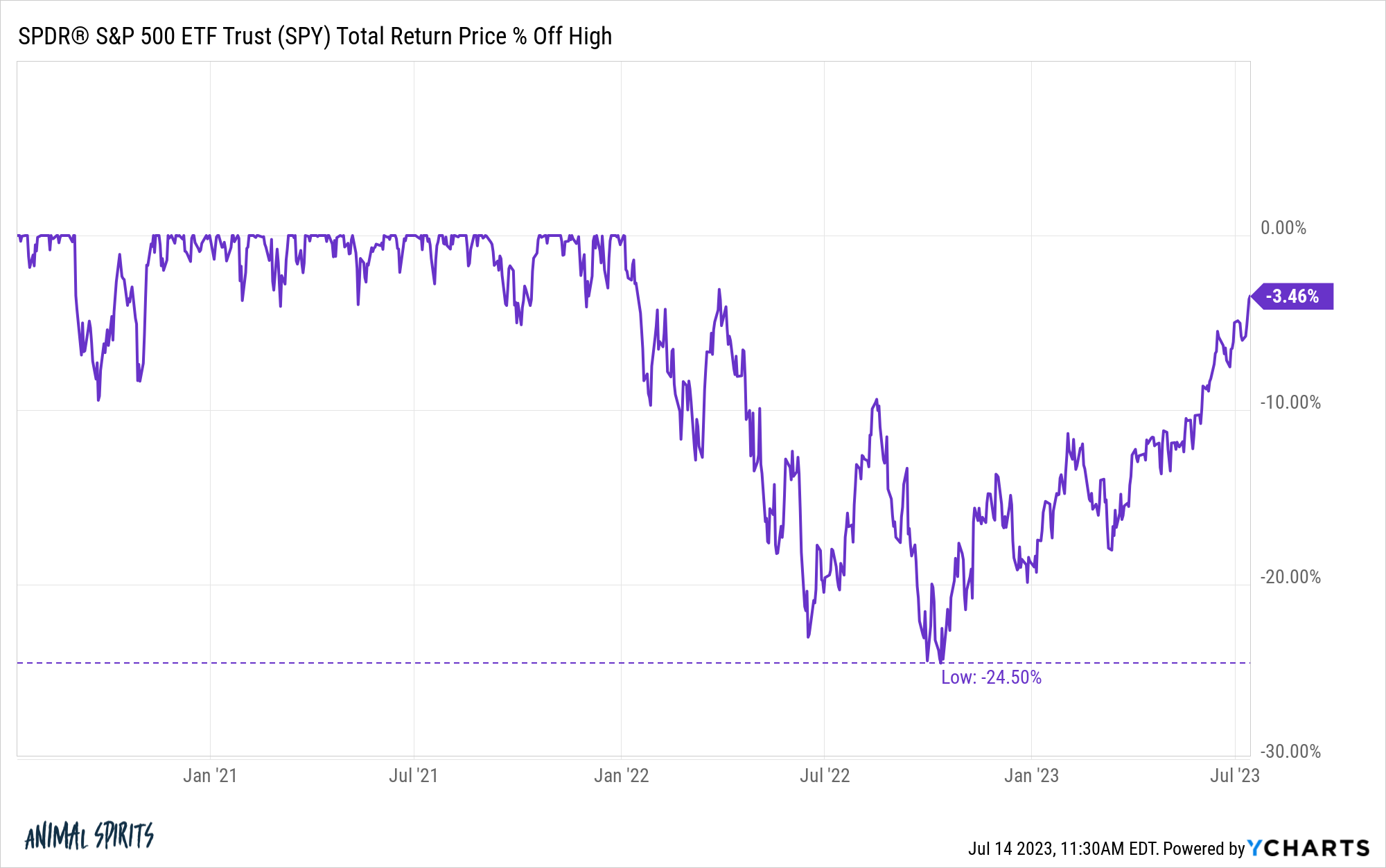

As luck would have it, 25% down was as bad as things got for the S&P 500. Here is a look at the current drawdown on a total returns basis (dividends included):

We’ve basically completely round-tripped.

As it always does during bear markets, it felt as if the world was coming to an end and things were only going to get worse, but here we are.

Now, I’m not trying to say you should try to time the market by holding a bunch of cash to take advantage everytime stocks fall.

Market timing is hard.

Predicting the timing and magnitude of bear markets remains nearly impossible.

My point here is that you don’t stop buying stocks during a bear market. If your plan says to rebalance, then you rebalance into the pain, even when it doesn’t feel comfortable.

You don’t panic sell during a bear market just because it feels painful to lose money. And you don’t make any rash moves when your emotions are high.

Bull markets don’t last forever either.

But it’s important to remember that bear markets are temporary.

Michael and I talked about bear markets, when to get long-term bullish and much more on this week’s Animal Spirits video:

Subscribe to The Compound so you never miss an episode.

Further Reading:

Getting Long-Term Bullish

Now here’s what I’ve been reading lately:

1Not guaranteed of course but a much higher probability than it was 15-18 months ago.