I’m a sucker for historical financial returns.

It doesn’t necessarily make it any easier to forecast the future but historical market data can help you better understand the potential risks and rewards for various asset classes and strategies.

Long-term returns are the only ones that matter, after all.

Jim Reid and his team at Deutsche Bank have a fantastic report called The Ultimate Guide to Long-Term Investing that has tons of great return data for nerds like me. They have data on financial markets going back 200+ years for some countries.

Let’s dig in.

I’ll start with the risks. A few weeks ago I wrote about why I don’t think we can have another Great Depression. In that 3-year window the U.S. stock market fell roughly 86%.

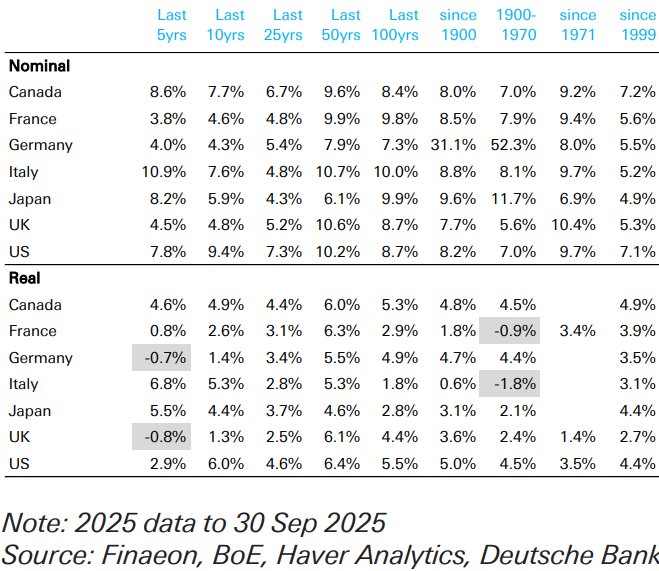

Those levels of losses have occurred in a number of countries around the globe, lasting for decades at a time in some instances:

That’s why they call it a risk premium not a reward premium.

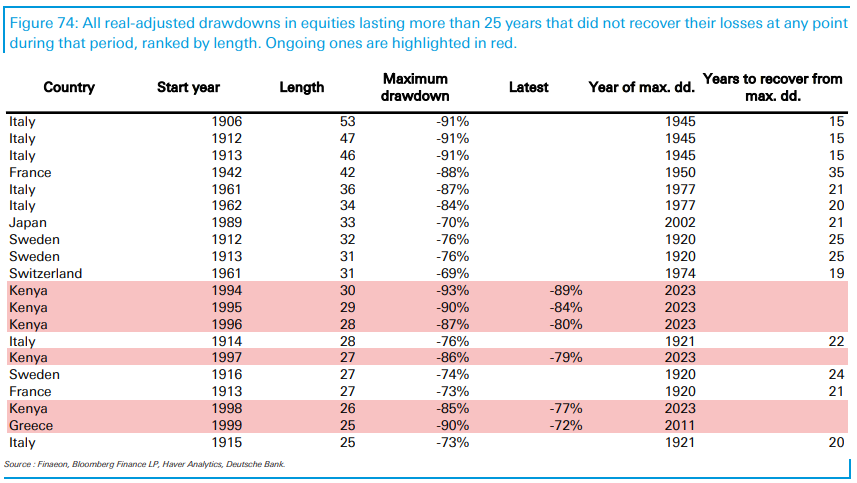

It’s also interesting to look at amount of times stocks have underperformed bonds or cash over time. This shows the percentage of time their global dataset of developed countries have underperformed bonds and cash over 5, 10 and 25 year time frames:

It happens more often than you think.

Owning stocks is not always easy.

OK, that’s the glass-is-half-empty stuff that needs to be shown to provide some balance.

Now let’s look at the good stuff.

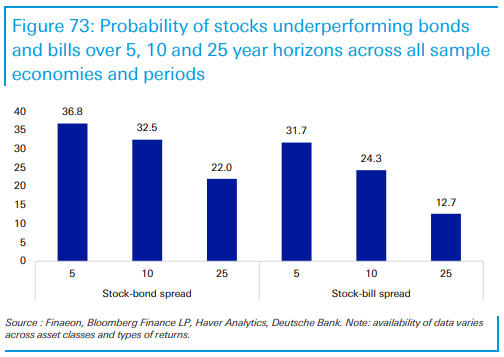

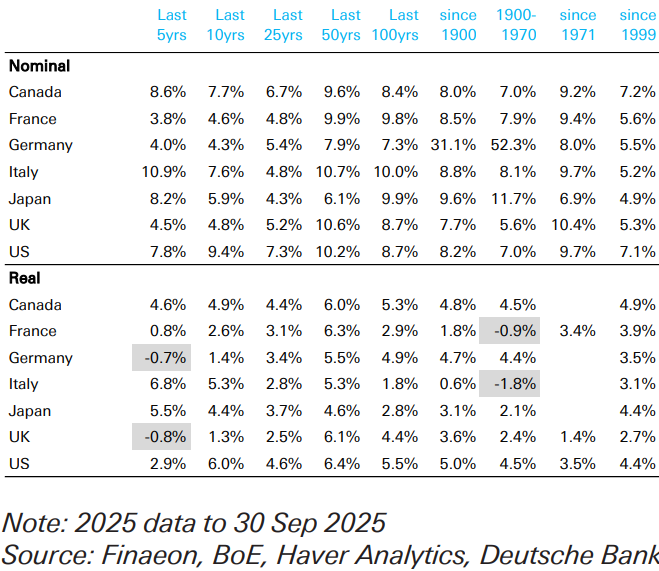

These are the nominal and inflation-adjusted G-7 coutnry returns over various time frames for 60/40 portfolios:

The nominal returns are higher than I would have guessed for many of these countries.

Of course, you have to look at these results on a nominal basis — especially the returns in the first half of the 20th century — to get an apples-to-apples comparison.

Still, over the past 50 years you’re looking at a range of real annual returns from 4.6% to 6.4% (6.1% to 10.7% nominal). That’s pretty good for a balanced portfolio.

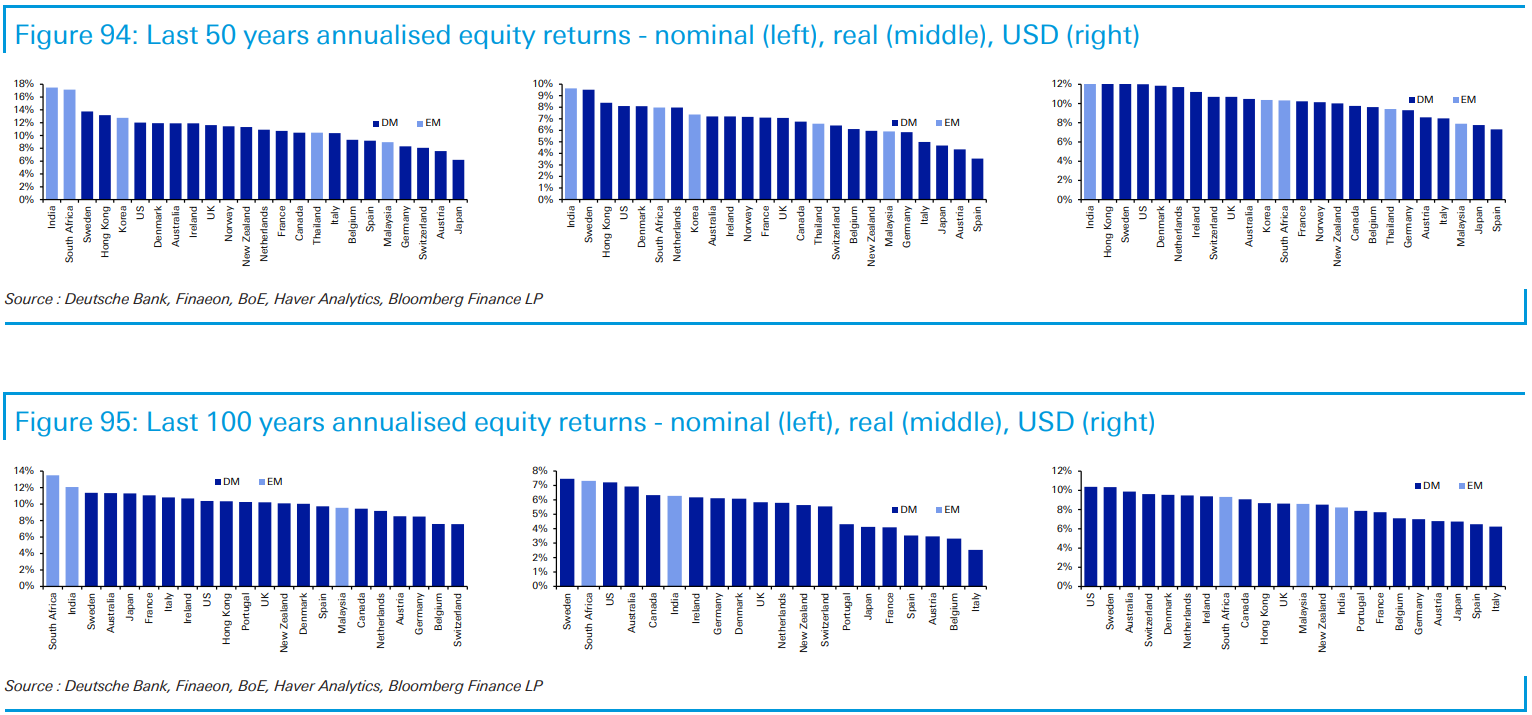

The next chart shows annual stock market returns over the past 50 and 100 years, this time inclusive of some emerging market countries:

A lot of bad stuff has happened to the world in the past 50-100 years – wars, famine, pandemics, natural disasters, depressions, energy shocks, etc.

Yet stock markets around the globe have gone up. This says a lot about the human spirit and our ability to innovate and improve.

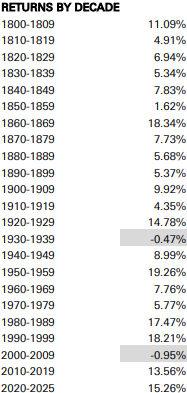

Reid also took U.S. stock market returns all the way back to 1800:

I’ve never seen returns by decade taken back this far. Remarkably, there have only been two decades with negative returns out of 23 in total.

It’s also notable that 5 of the 8 double-digit decades have occurred since 1950 (which has also happened in 5 of the past 8 decades).

Long-term financial returns have been quite strong no matter how you look at it.

Does this mean those returns will continue going forward?

It certainly doesn’t feel like innovation is slowing. No one predicted the impact AI would have on the markets or economy this decade. ChatGPT seemingly came out of nowhere but that’s mostly how this stuff happens throughout history.

People worry about the current state of the world. Then we innovate, fix some problems, create new ones and the cycle starts all over again.

As far as AI is concerned, there are many proponents who assume artificial intelligence will supercharge economic growth by making most tasks more efficient. That’s certainly possible, although if the robots replace most of the jobs we still need someone to spend money.

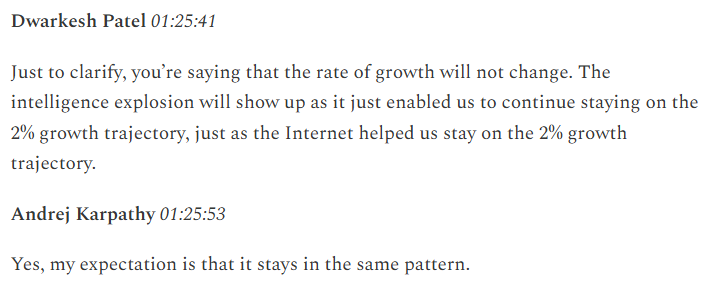

However, there is a growing consensus from others that AI will simply keep us on our current trajectory of growth. This is something AI researcher Andrej Karpathy talked about on the Dwarkesh podcast:

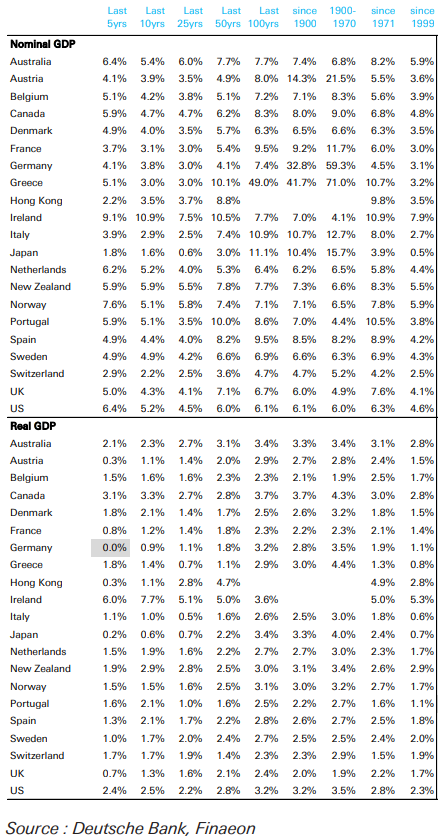

Deutsche Bank also shows historical nominal and real GDP growth for different countries over different periods:

Look at the real GDP growth going back to 1999 when the Internet really took off. Growth is around 2% despite the creation of a technology that has made us all more efficient in numerous ways. That’s lower than the growth over the past 100 years.

This makes sense when you consider the sheer size of the world economy. Trees don’t grow to the sky. But we still need the economy to grow in order for the stock market to grow over time.

I’m confident that will happen over the long-term, even though there will be some pain in the short-term to get there.

Further Reading:

30 Years