I’m at Future Proof this week with 4,000 friends in the financial advice space. Here’s a look back at the most popular post in A Wealth of Common Sense history.

*******

In 2014 I wrote a piece called What If You Only Invested at Market Peaks?

It’s hard to believe it now, but many investors assumed after a massive 30%+ run-up in the S&P 500 in 2013 that a peak was imminent.

So I decided to simply run the numbers as a thought exercise on the results of an investor who only invested their money at market peaks, just before a market crash.

I was more curious than anything and unsure about what the results would show. They were surprisingly better than expected.

I didn’t put much thought into this piece but it has become by far the most widely read piece of content I’ve ever written. It’s been read nearly a million times.

It still gets hundreds of thousands of page views a year.

I used this example in my book A Wealth of Common Sense but have always thought this story would be even better with visuals.

So with the help of our producer, Duncan Hill, I found an illustrator who could turn my story about the world’s worst market timer into a cartoon.

I updated some of the numbers, did some voiceover work, got the illustration just how we wanted it and had Duncan put it all together.

Here’s the finished product:

Most people who read my original piece understand it’s simply a story used to get across the importance of having a long-term mindset about investing.

But there has been plenty of pushback as well.

What about Japan?

What if stock returns aren’t as good going forward?

What if the world comes to an end?

There are always risks involved with any investment strategy but I believe thinking and acting for the long-term gives you the biggest margin of safety of any approach.

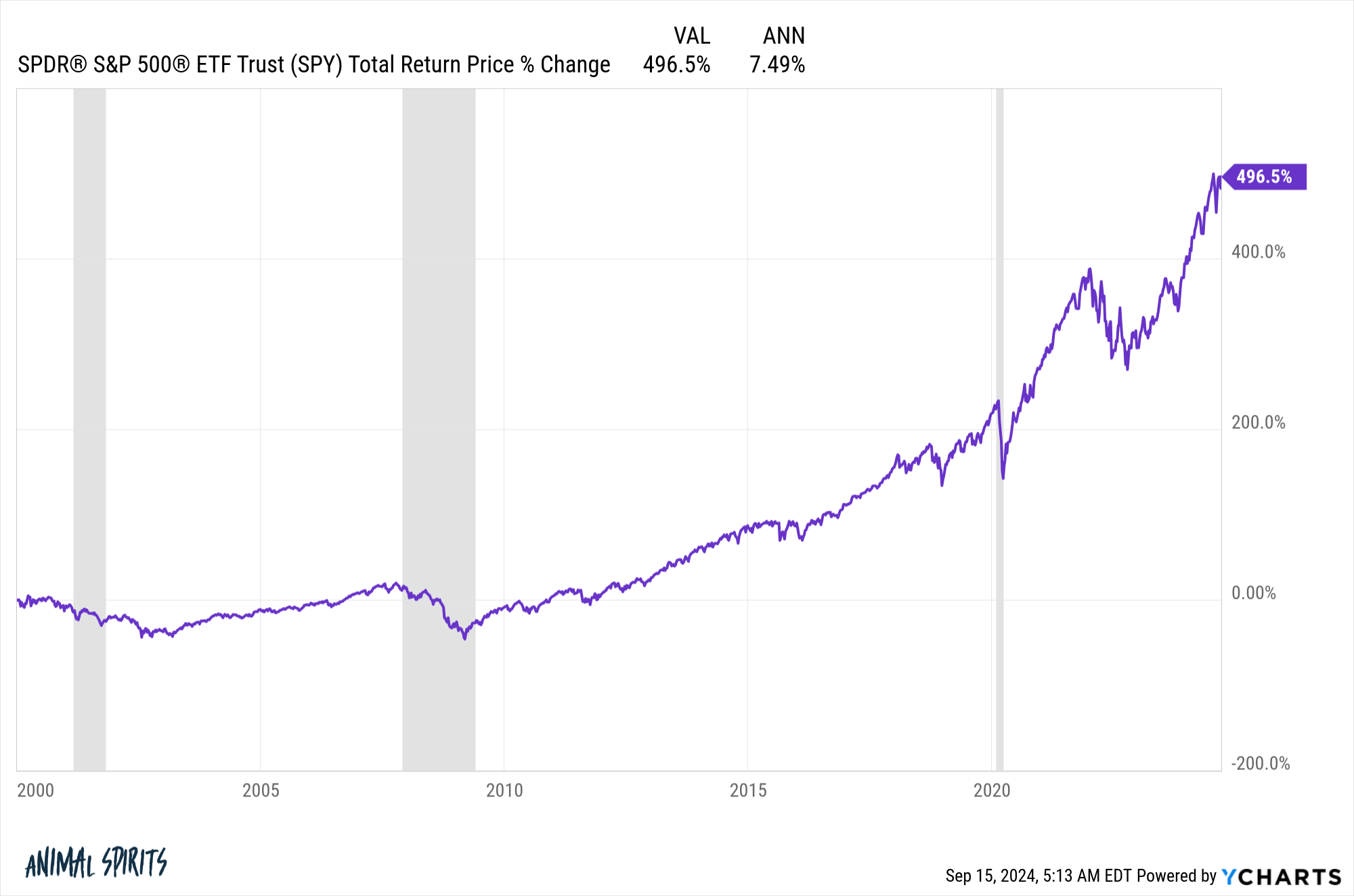

For example, had you invested at the tail end of 1999 when the CAPE ratio hit an all-time record of roughly 45x, that was likely the worst entry point in U.S. stock market history.

You would have been forced to sit through the ensuing crash from the dot-com bubble, the 2008 crash and this year’s Corona crash. That’s two times seeing the stock market get cut in half along with a 4-week period where it fell by a third. All in a little over two decades.

And what would you have to show for it?

Not great returns but certainly not terrible over 20+ years.

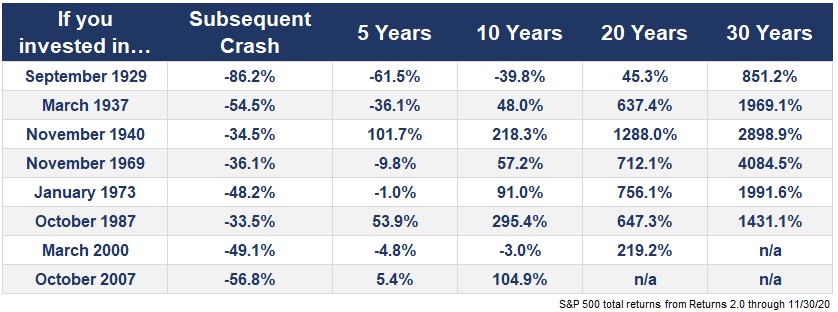

Sticking with this theme, I looked back at the long-term returns when investing at the peak of the market just before a nasty crash or bear market:

There were some lean times in there, especially in the aftermath of the Great Depression. But by and large, the long-term returns, even from the height of market peaks, look pretty decent.

I’m not suggesting investors are owed anything over the long-run. The stock market is and always has been a risky proposition, especially in the short-to-intermediate-term.

But if you have a long enough time horizon and are willing to be patient, the long-run remains a good place to be when investing in the stock market.

Further Reading:

What If You Only Invested at Market Peaks?

This content, which contains security-related opinions and/or information, is provided for informational purposes only and should not be relied upon in any manner as professional advice, or an endorsement of any practices, products or services. There can be no guarantees or assurances that the views expressed here will be applicable for any particular facts or circumstances, and should not be relied upon in any manner. You should consult your own advisers as to legal, business, tax, and other related matters concerning any investment.

The commentary in this “post” (including any related blog, podcasts, videos, and social media) reflects the personal opinions, viewpoints, and analyses of the Ritholtz Wealth Management employees providing such comments, and should not be regarded the views of Ritholtz Wealth Management LLC. or its respective affiliates or as a description of advisory services provided by Ritholtz Wealth Management or performance returns of any Ritholtz Wealth Management Investments client.

References to any securities or digital assets, or performance data, are for illustrative purposes only and do not constitute an investment recommendation or offer to provide investment advisory services. Charts and graphs provided within are for informational purposes solely and should not be relied upon when making any investment decision. Past performance is not indicative of future results. The content speaks only as of the date indicated. Any projections, estimates, forecasts, targets, prospects, and/or opinions expressed in these materials are subject to change without notice and may differ or be contrary to opinions expressed by others.

The Compound Media, Inc., an affiliate of Ritholtz Wealth Management, receives payment from various entities for advertisements in affiliated podcasts, blogs and emails. Inclusion of such advertisements does not constitute or imply endorsement, sponsorship or recommendation thereof, or any affiliation therewith, by the Content Creator or by Ritholtz Wealth Management or any of its employees. Investments in securities involve the risk of loss. For additional advertisement disclaimers see here: https://www.ritholtzwealth.com/advertising-disclaimers

Please see disclosures here.